We have the #1 site in Australia for “Mines For Sale” : $1bn assets for sale or seeking funding (incl. processing plant For Sale). Full data rooms with JORC/ technical data/ financial models available.

Please call Emma McPherson on +61 408 200814 or emcpherson@rockfinancial.net

Legend – Assets producing now, or near-revenue (6 mnths) in green. A$ funding sought in orange. JORC in red. Links to data in blue

Projects open only to Sophisticated or Professional investors, as defined under s. 708(8) or s.708 (11) of the Corp. Act 2001. RFA has no AFSL and provides no advice, opinion or valuation on any assets, nor any guarantee of outcomes. All parties should conduct their own due diligence.

Category 3: Processing Plant For Sale

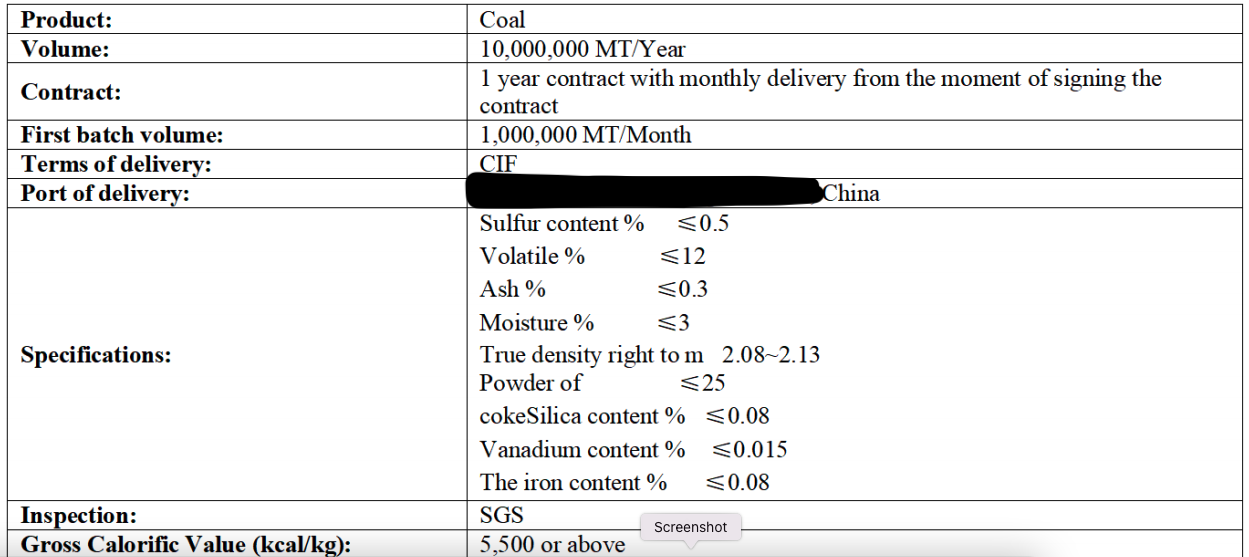

Buyer 1: Thermal Coal Chinese state-owned company looking for spot goods of 5500 GAR FOB Aussie port or and CIF Guangzhou 65,000 mt per vessel. The buyer is also looking forward to locking in a 3-year long-term contract, with +200,000 to 300,000 tons per month of purchas

Buyer 2: Iron Ore Chinese state-owned company looking for Iron Ore: 500,000 tons per month and for 3 month to 6 months contract. Iron Ore Fines 58-59% and Iron Ore 60-62%. Also C4 Iron Ore

Rock provides consulting services, which can be pre-paid via the links below

Please type in the pre-agreed AUD$ amount, and then follow links to enter your details

You will then receive an email confirming payment

If any questions please contact us at emcpherson@rockfinancial.net

Need a BFS done? Or a Financial Model for your project? Or general consulting? Visit our pages:

We specialise in Mining/ Infra/ Resources. Why waste time explaining to a non specialist?